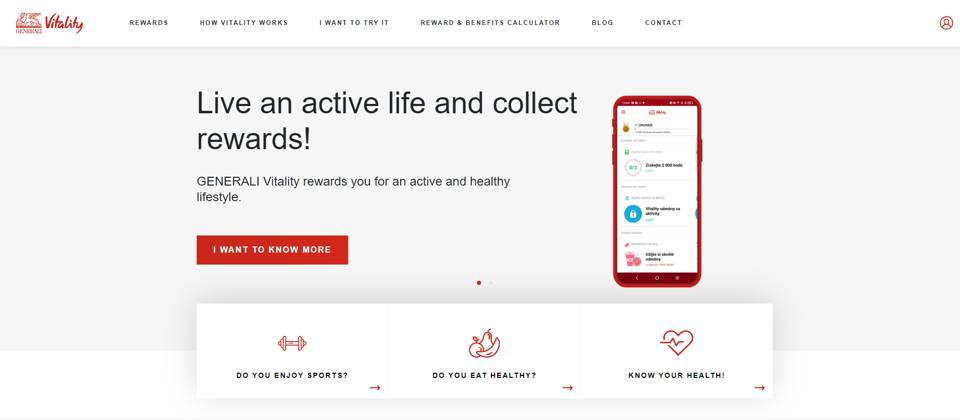

About

Bank of the West – everything you expect from a bank. And yet, fundamentally different. Bank of the West has the strongest environmental policies of any major U.S. bank. The 1% for the Planet Checking Account is the first bank account designed for climate action, designed to give 1% of its net revenue to environmental nonprofits, at no cost to the account holder, and is the first account in the U.S. to let consumers view the estimated carbon impact of their debit card purchases empowering them to drive change with their spending decisions.

Innovation presentation

The climate crisis is a very real and urgent problem, and yet only 3% of total philanthropic funds go toward funding environmental efforts. More alarming is that only 3% of that amount comes from businesses. Bank of the West recognizes that where you put your money matters, and we’re guided by the vision that banks can do financial good and drive positive change to combat climate change. So, where most banks talk about fees and convenience, we’ve decided to focus on principles.

Bank of the West has the strongest environmental policies of any major U.S. bank, and has chosen to restrict the financing of fossil fuels, big tobacco, Arctic drilling, and other activities that we believe are harmful to the planet. While these sectors may be lucrative for some banks, we don’t support ventures we believe to be environmentally destructive, and feel strongly that what we don’t finance is as important as what we do.

We know that there are consumers who share our views and were eager for other ways to fight against climate change. We just needed to find a way to get more consumers involved in sustainable finance.

In July 2020, Bank of the West became the first major bank to join the 1% for the Planet organization and launched the first, and only, checking account designed for climate action –the 1% for the Planet Checking account [https://www.bankofthewest.com/onepercent]. The impact of the account is twofold – both through donations to environmental nonprofits, and also educating and empowering customers to drive change with their spending decisions. Bank of the West donates 1% of net revenue generated from the account to environmental non-profit partners of the 1% for the Planet organization. The first recipient of funds generated by the account is one of the leading outdoor environmental groups - Protect Our Winters (POW). To date, Bank of the West’s total certified giving as a 1% for the Planet member, both through the 1% net revenue donations as well as through separate donations, is just over $4.5M. This significant support of environment nonprofits positions Bank of the West as one of the 1% for the Planet community’s top donors.

The 1% for the Planet Checking account puts sustainable finance directly into consumers’ wallets. It empowers consumers to drive change with their spending decisions. We're raising the level of awareness that banking and finance play in climate change, and educating consumers about the impact of their purchasing decisions. The account features a carbon measurement tool integrated into the mobile app; a first-of-its-kind for a U.S. checking account. Powered by the Åland Index, the carbon tool provides customers with the estimated carbon impact of every purchase they make with their debit card. This tool acts as a mechanism for giving consumers a concrete way to think about the impact that their individual purchasing behaviors have on the planet. At the same time, through advertising and long-form content in support of this product, we educate consumers on the inextricable tie between the money they put into the bank, and what that money finances out in the world.

It’s going to take a lot of money to course-correct a rapidly warming planet. We believe it is important to take action to address climate change and help create a healthier planet, and that educating consumers while also providing them with an easy platform through which to give back is an important step in the right direction.

While we’re proud of our societal impact, our sustainable policies are also resonating with purpose-driven customers and driving strong business results for Bank of the West. Select results from the launch of the 1% for the Planet Checking account include:

• Since launch, the 1% for the Planet Checking Account has resulted in a meaningful increase of new-to-bank customers and made up approximately 25% of new-to-bank checking account openings.

• 1% for the Planet Checking Account customers tend to be younger with a higher percentage under the age of 34; they also tend to be more digitally engaged, with higher retention.

• The launch resulted in a +29% increase in aided awareness to 71%, the highest in the Bank’s history. This put the Bank at the same awareness level as national competitors like US Bank and Capital One.

• The campaign drove the highest consideration levels the bank had ever seen. The +16% lift in consideration brought Bank of the West above key competitors like Ally and First Republic.

• Strong engagement and positive sentiment in social media: Our most successful social media campaign, performing at 19% above our Engagement Rate Baseline. The campaign earned 10x the reach of our prior best performing campaign and 21x the engagement.

• Strongest PR launch program to date with the earned coverage ad equivalency value equal to 10% of our overall ad spend.

The 1% for the Planet Checking Account represents just a piece of our broad sustainability work in support of our mission to be the leading sustainable bank in the US. Our sustainability policies demonstrate to our clients and competitors that it is possible to switch from business-as-usual banking to conscious banking while continuing to grow and deliver competitive services that can help society and the planet.

Uniqueness of the project

Banking institutions have the reach and resources to make a tangible impact on major issues facing our planet, including sustainability. Historically, banks have been a force for positive change in their communities, making investments in roads and valuable infrastructure to facilitate growth. After the industrial revolution came the birth of consumerism, and slowly the focus of banks changed as they became individual lenders.

Money deposited in a bank has the power to finance positive change. So we are taking action to support activities that help protect the planet, improve people’s lives, and strengthen communities. We are redefining banking for a better future by focusing on areas where we believe we can have a real impact, like the climate crisis.

Our 1% for the Planet Checking Account marked a number of firsts for the industry. It’s the first account designed for climate action and the first bank account to give 1% of its net revenue to environmental nonprofits through the 1% for the Planet organization, at no cost to the customer. And until we launched the 1% for the Planet Account, most sustainable finance tools were limited to those who had enough wealth to engage in impact investing. Through this first-of-its-kind account, we’ve democratized the practice of positive impact through finance. It’s an entry point to sustainable financing, and hopefully a larger conversation starter. Here are a few examples of conversations the account has sparked in the press:

• American Banker: “Bank of the West launches eco-friendly checking account”

• Barron’s: “20 Minutes With: 1% for the Planet CEO Kate Williams”

• Fast Company: “Fast Company - A bank account that’s good for the planet is one of Fast Company’s World Changing Ideas”

• Fast Company: “This checking account donates 1% of its revenue to climate nonprofits”

• Future Net Zero: “Bank of the West launches first bank account designed for climate action”

• Gear Junkie: “Climate-friendly debit card: Meet the first carbon-tracking bank account”

• Outside Magazine: “Your Money Might be Working Against the Environment”

The 1% for the Planet Checking Account represents just a piece of our broad sustainability work, and when combined with our restrictive financing policies, it’s part of what makes us one of the U.S.’s leading sustainable banks. Unfortunately, we are the exception--not the rule--within the industry. Since the Paris agreement in 2016, major global banks have increased financing of fossil fuel extraction to the tune of $1.9 trillion dollars. We can't do this alone: we need a fundamental industry shift to make a real impact in our fight against the climate crisis, and we need consumers to help drive that shift.

As an organization, we continually examine what changes we need to make to help reverse climate change and create a healthier planet—and then we work to make those changes. We look forward to continue to innovate in the sustainable finance space.