About

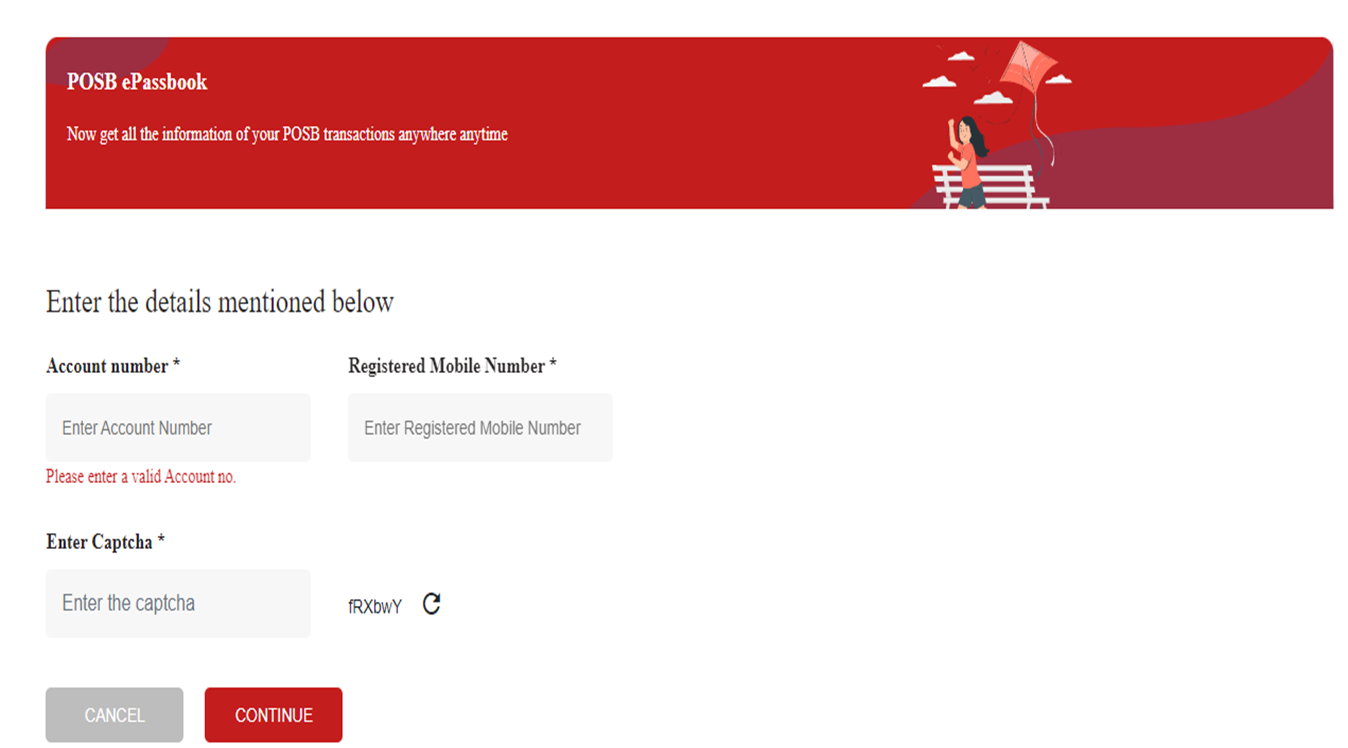

BMO Card Match goes beyond other chatbots, rethinking the way customers select credit cards through conversational AI. We deployed AI and machine learning to deliver personalized credit card recommendations to customers in real time using an intuitive conversational experience through IBM Watson Assistant.

Innovation presentation

BMO Card Match is a first of its kind conversational AI tool that focuses on delivering customers a personalized experience for guided online credit card selection. The conversational AI engages potential customers on multiple BMO.com product pages and leads them through a personalized flow based on their selections. This flow ultimately recommends the credit card best suited to their unique needs. BMO Card Match then allows them to learn more or apply for a new credit card within mere minutes from when the conversation started. BMO Card Match takes the guess work out of manual digital credit card selection.

BMO Card Match can quickly adapt its recommendations to respond to ever-changing customer needs. As a result of the pandemic, customers required a more personalized online experience and wanted cards that rewarded everyday purchases on grocery items instead of travel perks. BMO Card Match was easily adapted to these needs.

BMO Card Match goes beyond other chatbots, rethinking the way customers select credit cards through conversational AI. We deployed AI and machine learning to deliver personalized credit card recommendations to customers in real time using an intuitive conversational experience through IBM Watson Assistant.

Using BMO internal proprietary AI models to segment and cluster existing customers into distinct segments/personas, we were able to build a more holistic understanding of the customer and their preferences. In combination with IBM Watson Assistant, this enabled us to gather meaningful information about the customer and present them with their personalized card recommendation.

BMO Card Match like many products started with an idea to improve the digital customer experience by leveraging cutting edge technology. The product was brought to market by BMO’s internal innovation program, InnoV8, through a series of technical and business milestone-based gateways and was staffed by a small agile innovation pod, to have minimal members while delivering maximum impacts. As part of the iterative nature of the InnoV8 program, key performance indicators were developed to benchmark the specific project to ensure a successful pilot. Since then, BMO Card Match has exceeded all KPIs initially defined at every checkpoint.

Uniqueness of the project

BMO Card Match (A Canadian market first) engages with potential customers to recommend credit cards based on their preferences. We decomposed drivers of credit card NPS, and determined that we could drive higher adoption, spend, and loyalty by accurately assessing customer preferences and matching them to the most suitable credit card. The tool inquires about the customer’s credit card preferences and makes a recommendation based on their answers. BMO Card Match increases loyalty and customer happiness by understanding their needs in a personal and accessible way.

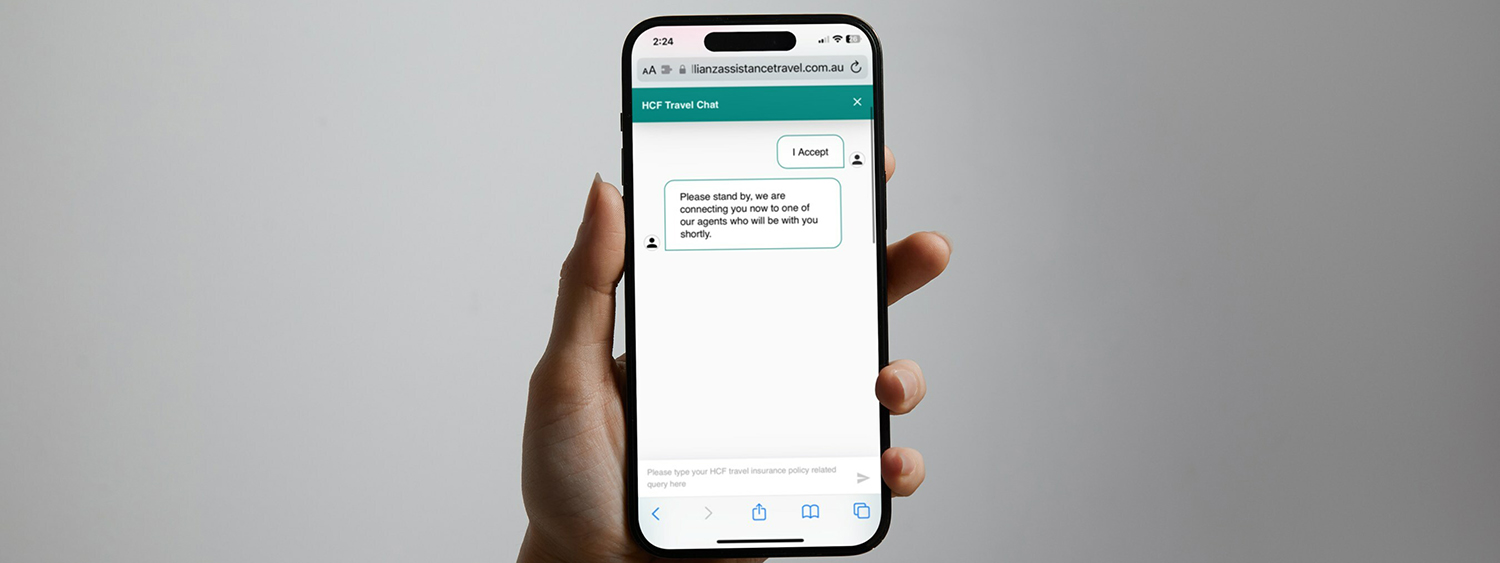

Other chatbots focus on support services, while BMO Card Match uses a proprietary “help me choose and apply” flow allowing us to create a truly unique customer experience. Users are presented with response options to streamline conversation flow, sliders representing their current spend, and personalized prompts using their name.