About

During the strict lockdown period, we supported our customers, facilitating their digitisation and providing them with tools, solutions and services to help them manage the situation caused by the pandemic. • Managing the moratorium in loans and cards through the online banking service, advancing pensions or paying furlough (ERTE) are just a few examples part of the communication actions carried out during that period. Digital communication with the customer has increased tenfold, with more than 1400 personalised communication actions carried out over a period of 10 months.

Innovation presentation

From the start of the State of Alarm decreed as a result of COVID-19, a communication action plan was established with the aim of closely supporting our customers from all available channels: the CaixaBankNow digital banking website and app; the outbound channels, such as the newsletter, SMS, push notifications; and our ATM network.

Faced with this new reality, we designed a series of communications aimed at the various arising needs:

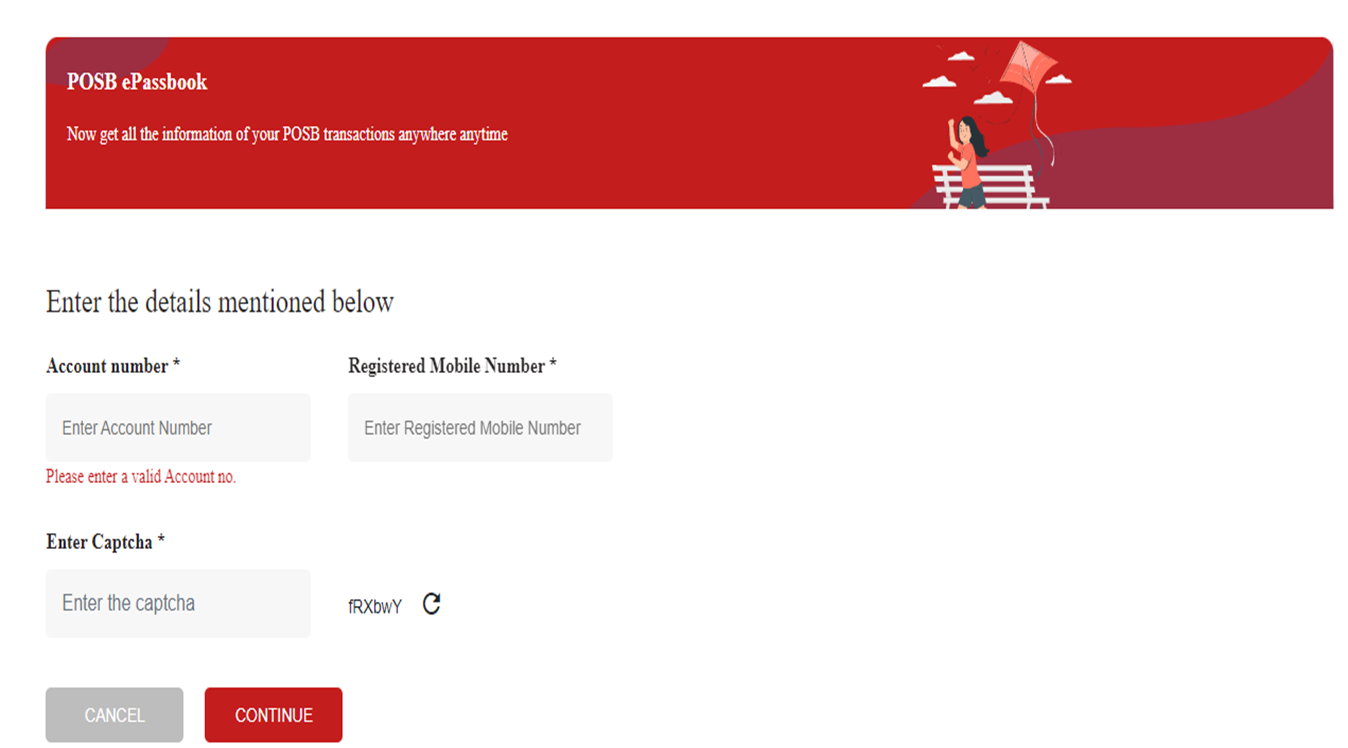

- Fostering digitisation among customers: accelerating the customer digitisation journey to provide our customers with the required knowledge and a seamless experience when switching from face-to-face to online channels.

- In very short periods enabling processes, such as managing moratoria in loans, cards and mortgages, that are carried out fully online from CaixaBankNow.

- Communicating all the measures available to help in the financial situation caused by the COVID pandemic: advancing payments for ERTE, pensions, unemployment benefits and the minimum life income, among others.

- Communicating all the advantages offered by the products taken out by our customers, such as making the most of the coverage offered by health insurance.

- Reinforcing the omnichannel relationship between the customer and the bank, by enhancing the digital channels with spaces to connect to the adviser: activating a communications wall to communicate via chat or video call for all customer segments. We have also provided the possibility of ensuring a secure face-to-face meeting by appointment.

- Creating an extensive set of audiovisual tutorials adapted to each type of customer (seniors, companies, businesses, establishments, individual banking, premier banking and private banking) and environment (website, iOS app, Android app and ATMs). This involved over 600 clips of less than a minute explaining, step-by-step, all the operations available on the digital channels. This content has also been very useful for the adviser network, which they have been able to share with their portfolio customers according to their needs.

Communication of valuable information:

Based on a customer-centric strategy, we generated valuable content to simplify the customers' daily life:

- Aimed at a heavy use in digital channels: support provided through video tutorials aiding in the use of digital banking operations

- Aimed at resolving adverse financial situations: suitable measures and aids

- Aimed at always being available to provide support to customers: omnichannel tools to contact and foster the relationship with advisers and the bank

Uniqueness of the project

From the start of the State of Alarm, a communication strategy was designed with the aim of catering to all the current needs from different scopes and suited to each type of customer: based on their segment and their degree of activity in the face-to-face and digital channels in order to personalise the solutions we have to offer and to use the most effective contact channel.

Digital capacity and communication actions that make the customer feel supported at all times. Communication actions through digital channels increased tenfold in 2020 as a response to the new needs arising from the pandemic.

We automated the communication actions closely linked to the customer's digitisation journey.