About

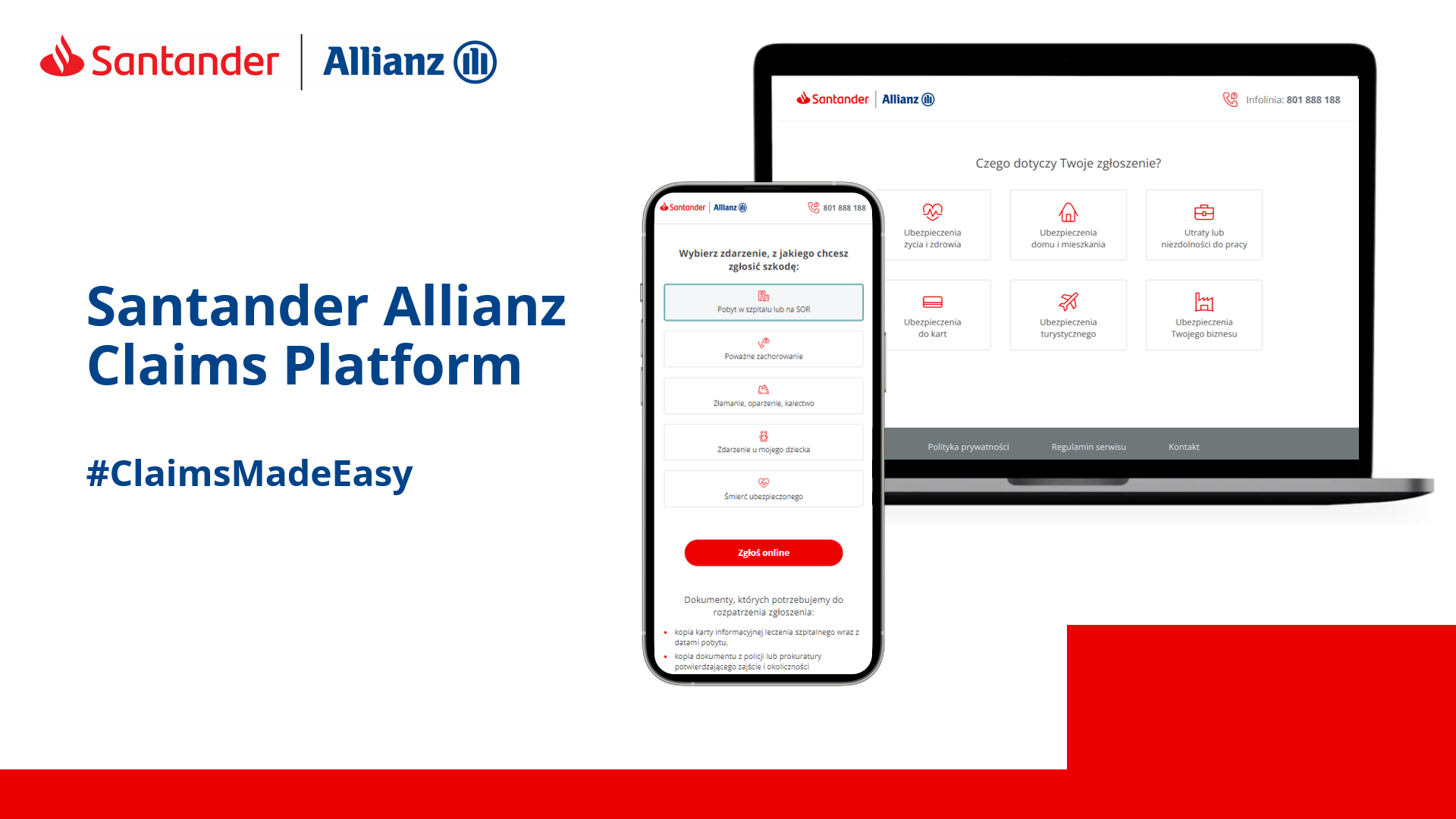

Frictionless customer experience applying "same for customer same for staff" principle - Simple

Innovation presentation

‘Africa is our home, and we are focused on driving her growth’ is a dictum we believe in and follow diligently.

Innovation

All services were developed away from the channel (glass) so as to ensure reusability across multiple channels ultimately resulting in a consistent experience across all our customer touchpoints. Standard Bank is passionate about the customer and building the digital bank that matters to our customer. Based on what matters to the customer we have come up with the following set of principles which use to design digital experiences :

1. Simple

2. Offers an awesome frictionless UI

3. Paperless

4. Straight through processing for instant gratification

5. Scalable

6. Available 24/7

7. Same for customer, same for staff

8. Embedded data

The project was implemented following SAFe Agile principles – with iterative drops planned in Sprints of 2 weeks each.

The Program Increment (PI) duration was aligned to overall Africa Regions PI duration of 10 weeks each – comprising of 5 Sprints of 2 weeks each.

This approach enabled continuous delivery of features which would pass through automated testing phases and thereby meant that the delivery was continuous and seamless

Automation was achieved in packaging and delivery of code deliverables using Jenkins tool, Testing was automated using Selenium and deployment was automated using Finacle’s in-house patch automation tool.

Following the strategic 8 digital principles in each aspect of the project meant that true digitization was achieved – reducing branch queues, speeding up the customer service in an effective and seamless manner.

The customers expect from us:

• Faster turnaround times – “we waiting too long in the queue”

• One and done – “why do I have to queue in different queues for different services”

• Paperless – “Why do I need paper to tell you what I want?”

• Frictionless customer experience – “as teller, make it simple for me to assist the customer”

As a result of the customer demands, Standard Bank collaborate with Infosys and have identified Moby Branch Banker as the digital front-end choice for the entire branch network.

Our Business team did a detailed study to identify the most used services by customers when they walk into the branches – a set of 32 most used branch processes were identified that will address 80% of the volume.

Given the significant of change required from a Bank perspective, only two years after deploying the new core banking system, we realize that key leadership principles will be required and adopt the following:

• Freedom to design from zero base

• Empowerment of teams

• Bravery

• Business buy -in and unconditional commitment to change

• Focus on customer requirement not technical capability

Uniqueness of the project

Digital Transformation

The Africa Regions Moby team collaborated with Infosys and identified Moby Branch Banker as the digital front-end of choice for the entire branch network. The team used digital principles to design a truly digital experience focusing on simplicity, an awesome frictionless user interface, paperless processes, straight-through processing, reduced internal controls, moving towards one screen for staff and customers and a scalable solution.

The Moby Banker solution developed in partnership between Infosys and Standard Bank Africa regions was a first in the world initiative and has already received global recognition.