About

The free in-app service to compare, change and optimise utility bills through a 100% customer journey

Innovation presentation

In recent years, also due to the Covid-19 pandemic, inflation affected the society more than ever; specifically, utility bills, including both gas and electricity, have risen considerably and consumers started searching for cheaper and affordable utility bills solutions. In this context, to fill the increasing demand for more convenient services, Intesa Sanpaolo decided to integrate Switcho, a digital platform that compares the majority gas and electricity offers in the market, into the Bank Mobile App.

The integration of Switcho is in line with a broader Intesa Sanpaolo Open Banking and Ecosystem strategy, and it represents the first non-financial service integrated directly in the bank’s app.

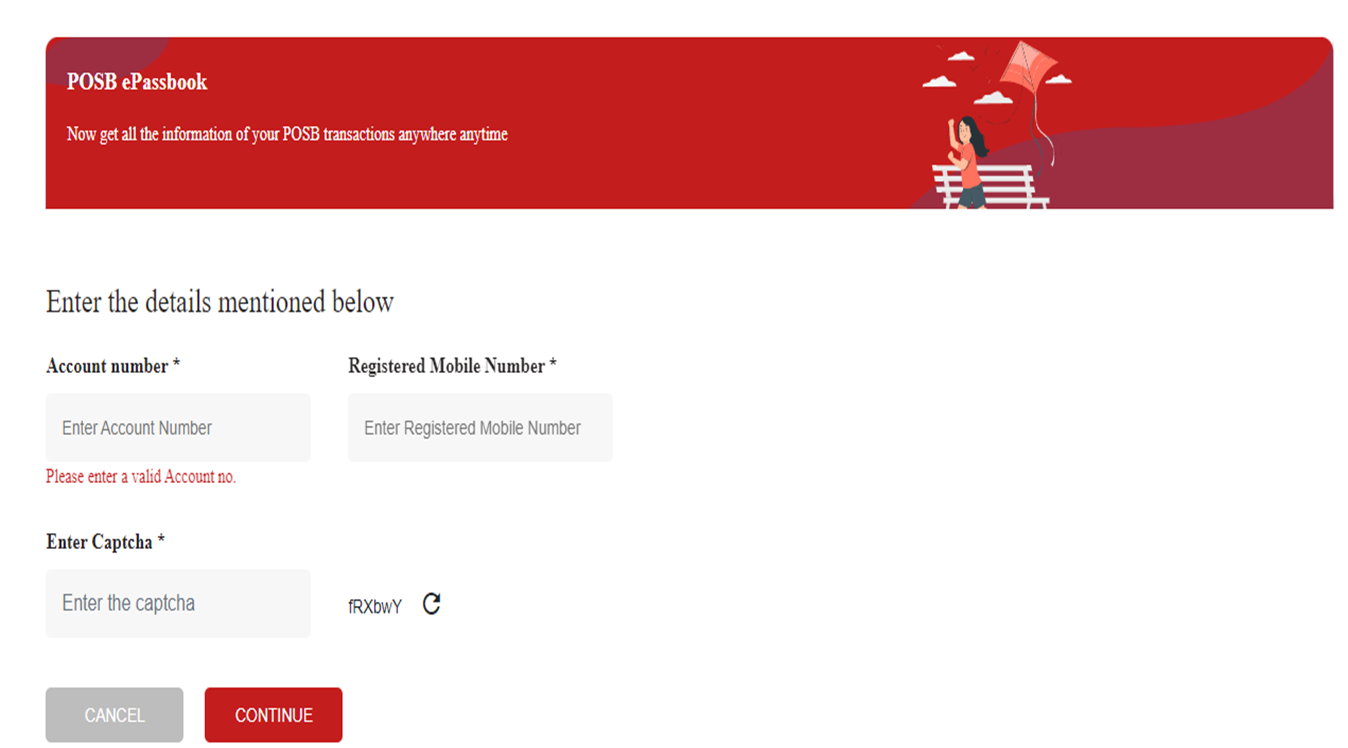

Regarding the user experience, in fact the customer through the Mobile banking App is redirected to Switcho dedicated properties, a 100% digital and free platform.

Thanks to this solution, Intesa Sanpaolo’s customers are enabled to save time and money on household utilities by “switching” provider, resulting in a smoother digital Customer Journey: the user uploads utility bills into Switcho, that latter manages the entire process.

Specifically, user selects the type of utilities of interest (gas and/or electricity), uploads their actual annual utility plan, and receives a confirmation of the request submitted. Subsequently, Switcho elaborates the query, suggests cheaper rates and/ or suppliers (among a wide range of providers such as Eni, A2A, Pulse,etc), and shows a view of the estimated annual saving.

Once the customer chooses the electricity/gas solution that better fits its needs, Switcho entirely manages the bureaucratic aspects of the “switch” and notifies Intesa Sanpaolo’s customer as the process is completed.

Moreover, unlike classic rate comparators, after making the "switch", users can have an estimate of the annual expenditure and therefore know how much they would save each year.

Uniqueness of the project

Thanks to the partnership between Intesa Sanpaolo and Switcho, consumers benefit from the provision of a value-added service, enabling an overall improved Customer Experience and several advantages such as:

● Money saving on domestic utilities, thanks to a comparison between the majority providers on the market

● Time saving thanks to a process completely managed by Switcho

● Fully digital in app customer journey thanks to a 100% digital platform

Furthermore, the partnership allows Intesa Sanpaolo to leverage on the following opportunities:

● Touchpoint evolution - creating new touchpoints by responding to customers' needs and strengthening their relationship with the Bank; moreover, Switcho contributed to Forrester's rating of the Intesa Sanpaolo Mobile App, rated as #1 App banking in Europe

● First integration of a non-financial service in the ISP mobile app - integration done in WebView (Android system component to embed web applications) with minimization of costs and development time, compared to traditional integrations. Moreover, the contractual model is replicable for further non-financial services, thus facilitating future partnerships and evolutions

● New business opportunities - possibility to integrate non-banking value-added services and enable new business opportunities for the Bank in areas not yet covered, thanks to PSD2 and the Open Banking market

In the future, the Bank aims to enter other partnerships to enable the integration of non-financial value-added services to capitalise on synergies and to continuously respond to customers' needs and market demands with the goal of offering a “Bank always in the pocket”.